Contents

He supports this conclusion with examples including the jelly-beans-in-the-jar experiment in which 56 people were asked to guess the number of jelly beans in a jar that held 850 beans. Notably, of the 56 guesses, only one guess beat the group average estimate. Trade Cryptocurrency Exchange: Beaxy Review with PaxForex to get the full Forex Trading experience which is based on… The main signal type is the exit from the overbought and oversold areas. In this case, it is preferable to use RSI, rather than Stochastic, which is more complicated in perception .

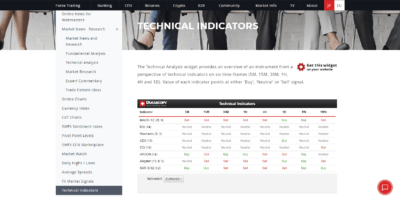

For example, news trading is based purely on fundamental analysis and is extremely short-term and fast. In technical analysis, Forex oscillators are indicators of the speed of price movement for a specific period of time. They belong to the leading indicator that can move around the zero line in the interval from 0 to 100%. During those time intervals when the price is stable, it either moves only within the channel or is briefly suspended to reverse. The oscillator in the Forex market is designed to find points, after which the price will move either along the trend or towards the back border of the channel. Automated forex trading software improves your success rate if you trade using spreads.

Custom Indicators – those that traders create and place in the open-access network . Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. Macroeconomic variables have complex feedback effects, such as income causing money at once scale, but money causing income at another, and our tools help you choose the resolution you want. Classical tools in finance such as regression analysis are ‘global’, drawing trend lines without making fine distinctions about context.

This try-before-you-buy option will enable users to try out each broker’s software during a trial period and determine which software and broker best suit their needs. Calculate trade suggestions based on your company parameters and forecast cycles. The success of a trader is partially dependent on knowing when to buy a currency and when to sell.

Conversely, we emphasize local effects as many different contexts get merged together. Forex trading is legal, but being a trader, you need to follow the regulations specified by your respected countries. Improve the accuracy of your hedge program with actionable categories that help you move it forward. Gain insight and oversight over FX exposures with automated exposure aggregation, reporting, business intelligence and workflow integration. When opening a trade based on your forecast, you must assume some chance of failure, taking relevant protective measures — in most cases, a simple stop-loss order. Social Media Analytics provides the quantitative and financial communities an NLP-powered tool to enhance returns, reduce risk, and evaluate financial reports.

This doesn’t forecast what the exchange rate should be, but allows traders to decide whether they think it is heading higher or lower. 74% of retail client accounts lose money when trading CFDs, with this investment provider. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Interactive Brokers offers a similar breadth of currency pairs as thinkorswim, with more than 100 to choose from. (https://colorreflections.com/)

DON’T BE FOOLEDby “profitable” ruleswhich fall apart when traded.

From keeping an eye on the market movements and making investments in placing stop-loss orders and implementing trading strategies, forex traders have to deal with many activities. Forex trading professionals use trading software and tools to bring efficiency to their work & easily execute the most advanced and complex trades. The software’s analytical tools, along with the third-party plugins, can examine the market in-depth.

It is still one of the best indicators for forex trading among different methods of determining the volatility channel. Basically Adaptive Modeler can be used with any market price data or other time series such as gold, silver, platinum, oil, etc. As with all markets, forecasting performance will depend on the efficiency and predictability of the market, which typically varies over time. Its flexibility, coupled with the success of countless traders with different levels of expertise, proves that there is more than one way to eat an elephant.

So, remember, whenever and wherever you see/hear something like that – stay away, it`s most likely a scam. The point here is that there is no software at all or it`s a phony used by the marketing 3rd parties. When you try to get the software promised you are told to create an account with a particular broker and later will find out that there is no software at all. Forex Moving Average Convergence Divergence shows the convergence and divergence of moving averages.

FOREX rate prediction using ANN and ANFIS Conference

Both are specially designed to predict the future trend of the foreign exchange market at any point of time. The web-based software is considered to be safer than the client-based version. The trader just needs to sign in into the application and the software start predicting the market trends. Most of the Forex software takes an hour long move for determining the short and long positions.

The concept of technical analysis is all centred on supply and demand, using a variety of tools to find trends and patterns in the past in the belief that those same patterns and trends will happen again. Technical analysts believe you can gauge a lot from just a chart, with these patterns and trends signalling the mood of the market and any changes in sentiment. The aim is to identify them before they happen in order to capitalise on the opportunity. Another major factor that will influence what approach to take is the timeframe in which to trade. (Provigil) Many short-term forex traders will start afresh each day, closing out all of their positions before the end of the day in order to avoid any drastic price movements that could occur overnight, known as day trading.

Neural Network Based Forecasting of Foreign Currency Exchange Rates

For the purposes of this demo, weekly historical data of exchange rates were obtained from the Monetary Association of Singapore , spanning across January 1998 to April 2015. While our software typically runs real-time predictions, this demo will only be using historical references. Please note that the results for this demonstration only compares SGD vs USD. A forex trading bot or robot is an automated software program that helps traders determine whether to buy or sell a currency pair at a given point in time.

A forex trader psychology is the aptitude of a trader in handling forex trades uniformly. It is a distinguishing characteristic of the trader, which can be enhanced with software assistance. Some software applications can improve their mindset and boost them to become top performers. “NeuroShell Trader combines traditional and artificial intelligence techniques to build trading strategies that can be backtested and optimized.”

The software can instantly note a price gap and execute a sale or purchase on your behalf. These range from automated strategies for order executions, education and training as well as hundreds of indicators, signals and strategies to personalize your platform. User-developed apps built by the NinjaTrader community of 60,000+ traders are also available for free.

Retail traders need automated algorithms that execute trades accurately and instantly. The automated / robot trading features of the software minimizes the manual errors that may occur while executing trades. Automated trading features are also flexible enough to identify and adapt to sharp fluctuations in the market. Traders can improve FXOpen Forex Broker Review their market aptitude when agile trading automation helps them tread through changing market conditions. Due to the high commission costs, more investors prefer doing their trading analysis through this software. They ensure they get complete control over the trading platform for using their self-directed trading accounts.

- I’d like to receive information from IG Group companies about trading ideas and their products and services via email.

- However, one of the biggest drawbacks of the forex market has always been its high time consumption.

- Exit from the overbought area also indicates the beginning of a downtrend.

- He has authored books on technical analysis and foreign exchange trading published by John Wiley and Sons and served as a guest expert on CNBC, BloombergTV, Forbes, and Reuters among other financial media.

A trading demo account is a tool that allows an investor to test a trading platform before funding the account or placing trades. Long-term investing requires identifying the trends that really matter, and our toolbox lets you filter all the extra noise from the reliable signal. From intraday trading patterns to four-year election cycles, we help pull apart these competing trends to help you anticipate what comes next. Since everything in an economy affects its currency’s success, we identify the cycles most relevant to you.

Trend Based Analysis

One more important point to take into account while looking for a stock market forecasting software is where to get it. Finding just whatever software is not a problem – there are hundreds of search results with 90% of them saying “stock market forecasting software for FREE”. Obviously, you should not expect much from such programs since usually if you pay nothing you get nothing. Baring in mind that the Forex market is constantly moving, forecasting the next steps can be quiet a challenge.

Psychological – study market sentiment, make predictions actions of traders. At the same time, it should be understood that the situation in the financial assets market is constantly changing. There are hundreds of economic scenarios and modern realities such that every month new economic and trading models emerge.

That is why finding a real working Forex forecasting software is to help with that, easing the process of analyzing the charts and improving your trading experience. Exponential Moving more accurately displays market prices but tends to react very strongly to changes in value. Traders often use it for short-term trading to capture the price instantly. Here the choice is always between sensitivity and the desire to reduce the number of false signals.

From e-books and coaching sessions, the forex software hosts a range of online learning experiences for investors. Improved neural network and fuzzy models used for exchange rate prediction and their performances for one-step a-head predictions have been evaluated through a Exchange-Traded Funds: an Overview study. The objective is to predict single day exchange rates with higher accuracy and precision by using two different methods, i.e. a Neural network and a Hybrid system. CapellaFX is the first FX risk management software that integrates your entire hedge program workflow.

It improves their capabilities, not only as a forex trader but also as a high-earning individual. One of the best features of forex trading software is its ability to place trades simultaneously and instantly. These orders include market orders, buy orders, sell orders, limit orders, and stop-loss orders. Some software also helps traders place advanced order types and customize their placements based on their trading plans. The order placement feature of the software can monitor the real-time prices of the currencies and view their suitability in the order book.

Kyriba delivers complete and accurate extractions from ERP systems and spreadsheets for in-depth visibility into exposures, reliable analysis and informed risk mitigation. Earnix is a leading provider of mission-critical systems for global insurers and banks. Through Earnix, customers are able to provide prices and personalized products that are smarter, faster, and safer in full alignment with corporate business goals and objectives.